Playing with a Cepheid SmartCycler 2

I’ve been playing with an old SmartCycler 2. Luckily the instrument came with a manual, centrifuge, and critically software.

I decided to try it out with the Tribo Science Fast DNA extraction kit and Tribo Science Chicken qPCR kit and a selection of meats:

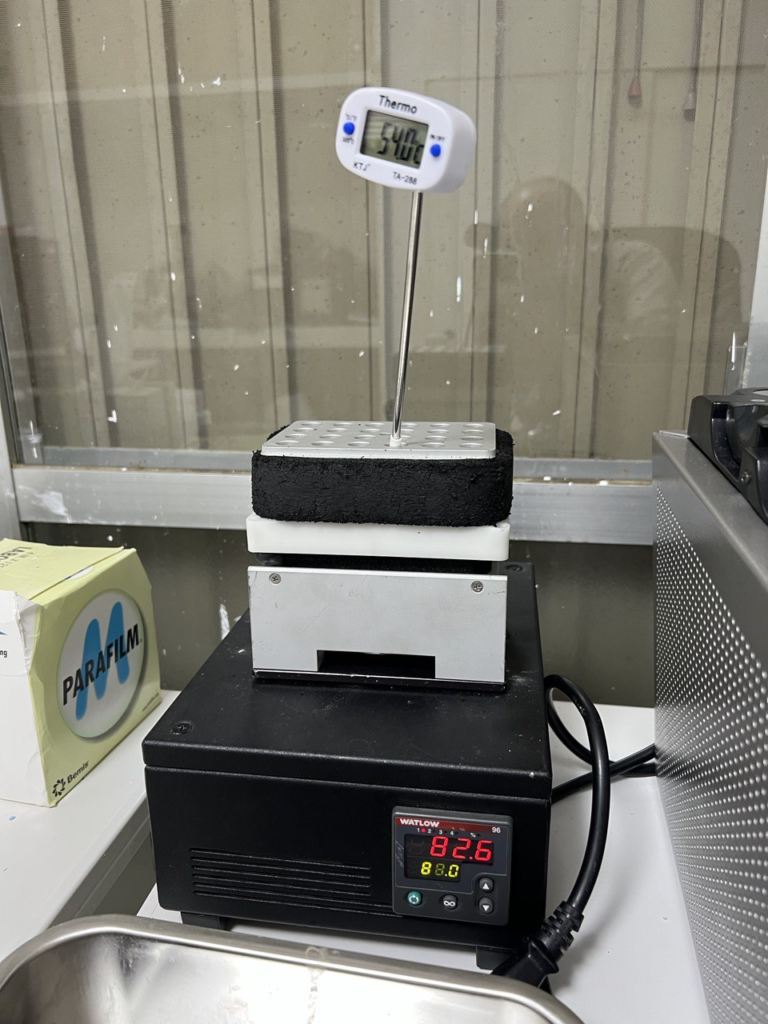

The extraction kit is pretty simple, composed of only a single reagent, you also need some TE buffer (I used TBS5009) and Nuclease free water (LSKNF0500). I used an old Gilson P200, and AmpliPur filter times. The extraction reagent needs to be heated to 68 degrees. I used a random heat block “thing” I had in my junk pile:

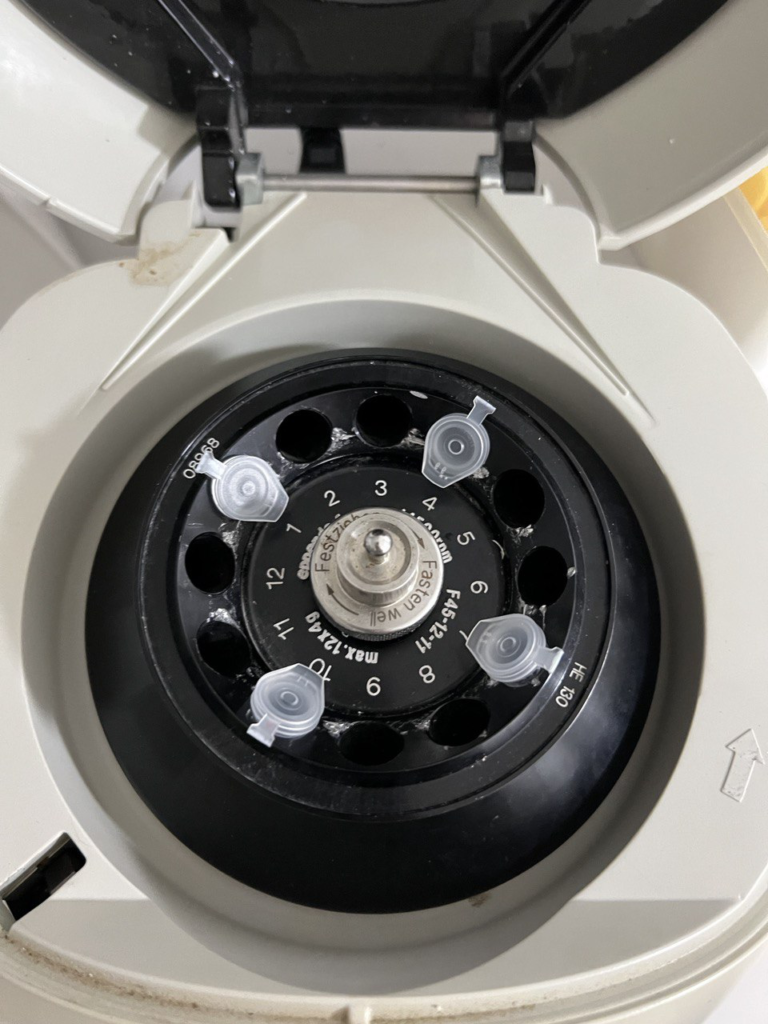

This, more or less worked… final stage of the extraction is a spin in my Minispin that’s seen better days…

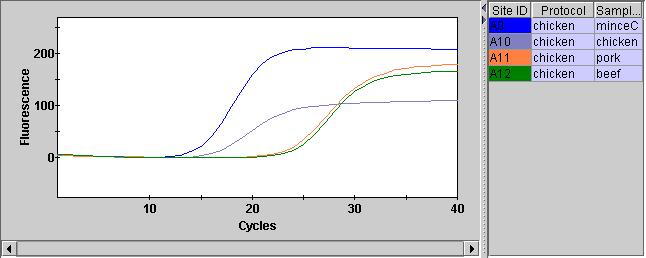

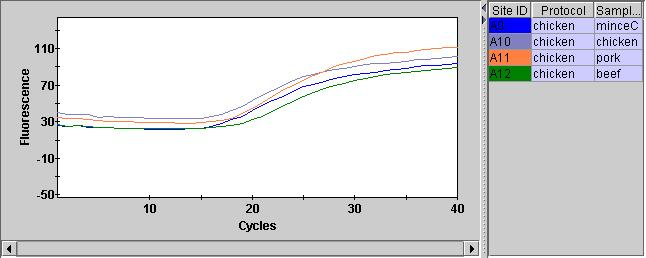

After adding the qPCR reagents, and giving them a quick spin in the SmartCycler custom rotor we can run them on the instrument. The FAM channel (assay) looks pretty good. And we can see that the two chicken samples have Ct values below 20 (15.51 and 18.43). Interestingly (and understandably) the minced chicken has a lower Ct value. Quantifying the material with a Qubit also suggests we have much more material here.

The Pork and Beef Ct values were both >20 (24.76 and 25.31). This isn’t as documented in the protocol where negatives should show Ct values of > 37. Perhaps there was some cross contamination.

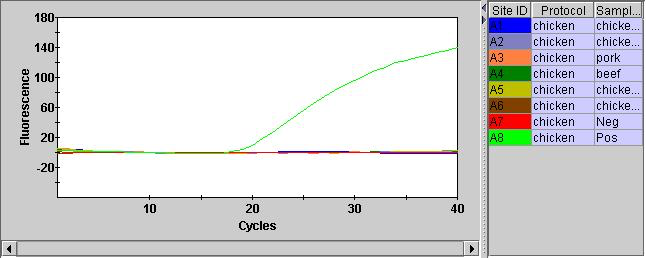

I also ran the positive and negative controls. The positive control showed a Ct of 22.30. Here shown with a number of failed samples:

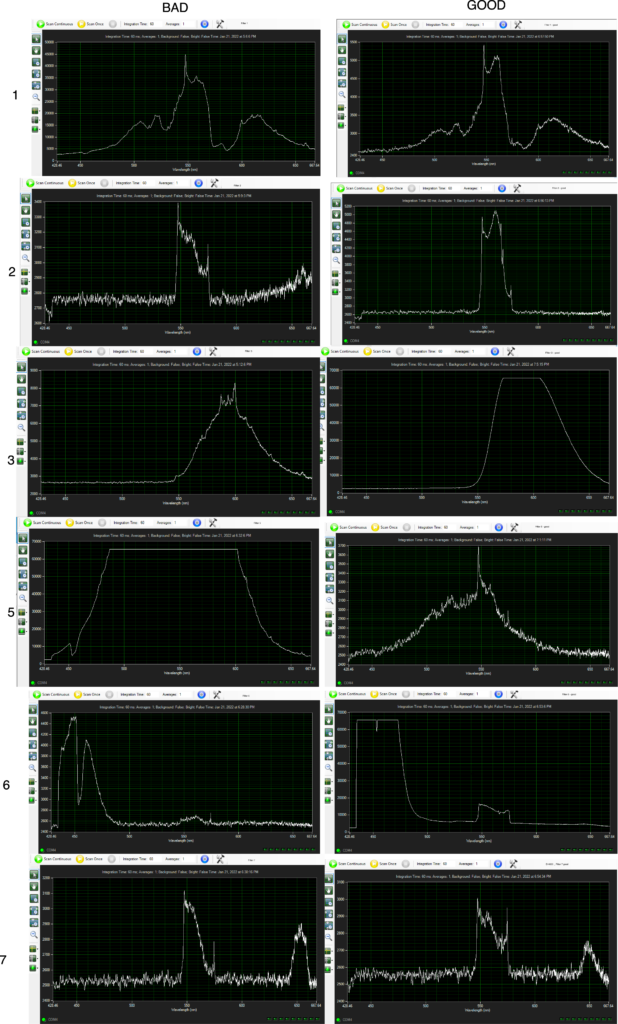

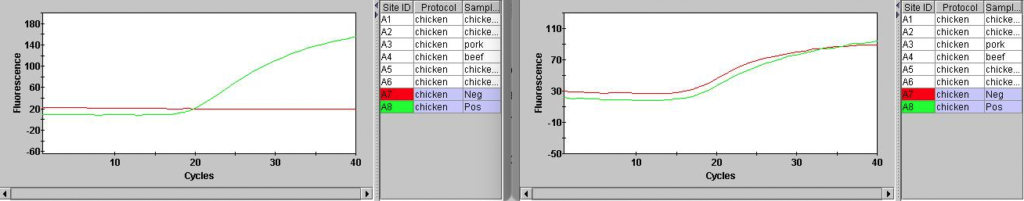

Overall, the instrument and assay seems to be working to some degree! A significant issue is that the internal control (Hex) is not showing anything. They Hex channel just wiggles around unconvincingly:

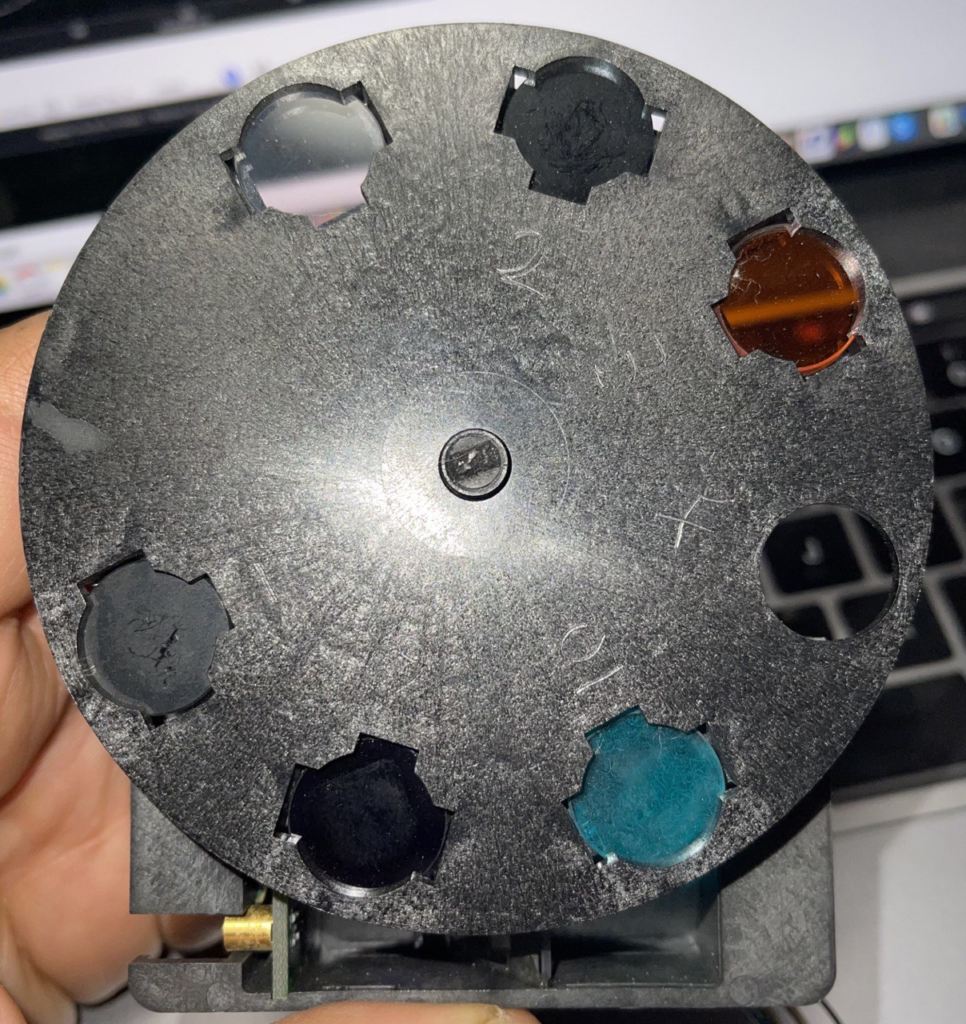

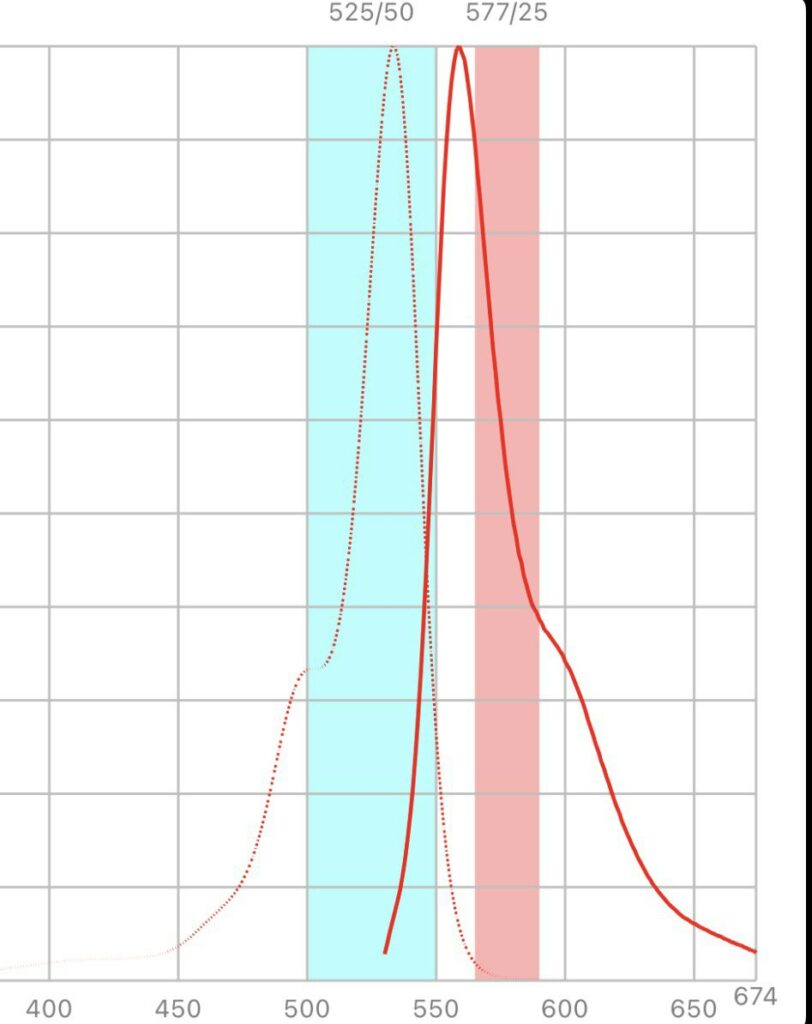

Looking at the excitation/emission spectra for Hex and the filters in the SmartCycler suggested that it could work on the SmartCycler:

But Hex isn’t listed in the SmartCycler documentation, and various dye compatibility documents that list Hex suggest that it doesn’t work on the SmartCycler. There’s a process called Optical Calibration which might help… so I might take a look at this further.

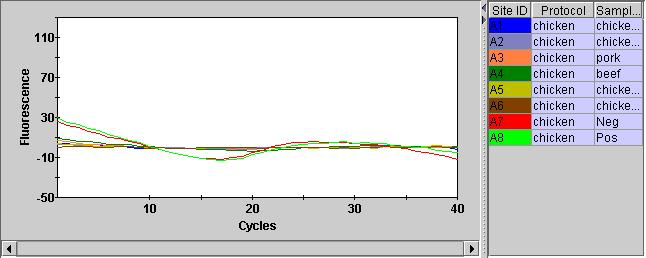

UPDATE: Turning background subtraction off on the internal control channel seems to result in much cleaner traces…

This also looks better in the positive and negative controls:

Overall the fluorescence seems to be much lower in Hex, which I suspect is why the background subtraction in failing. This is probably why Hex is not recommended for use on this instrument…

Failures

In my first run only the positive control worked. There are a few potential issues here:

- I’m not sure I fully thawed the extraction reagent.

- The heat block wasn’t up to temperature (I was using the reading on the PID controller, which doesn’t reflect the tube temperature well).

- I had all four channels enabled on the SmartCycler, this may not matter but I turned off the unused channels anyway… perhaps there’s potential for crosstalk, who knows…

- In both cases I used the FCTC25 dye calibration set.

- I used the Cepheid cooling block on the second run. The block was cooled on ice.

In any case after resolving these issues everything (except from the Hex control) seemed to work more or less as expected.