Thoughts on interviewing with YC as a science based startup

TDLR; Applying to YC is an interesting experience, and have a clearer process than many VCs. I would recommend it, even for solo founders and science-based startups.

I applied to the YC winter 2019 batch. I viewed the whole process as relatively low probability. YC gets more than 5000 applications. Out to these ~500 get invited to interview onsite.

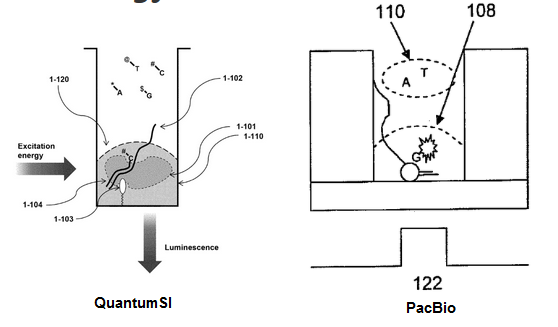

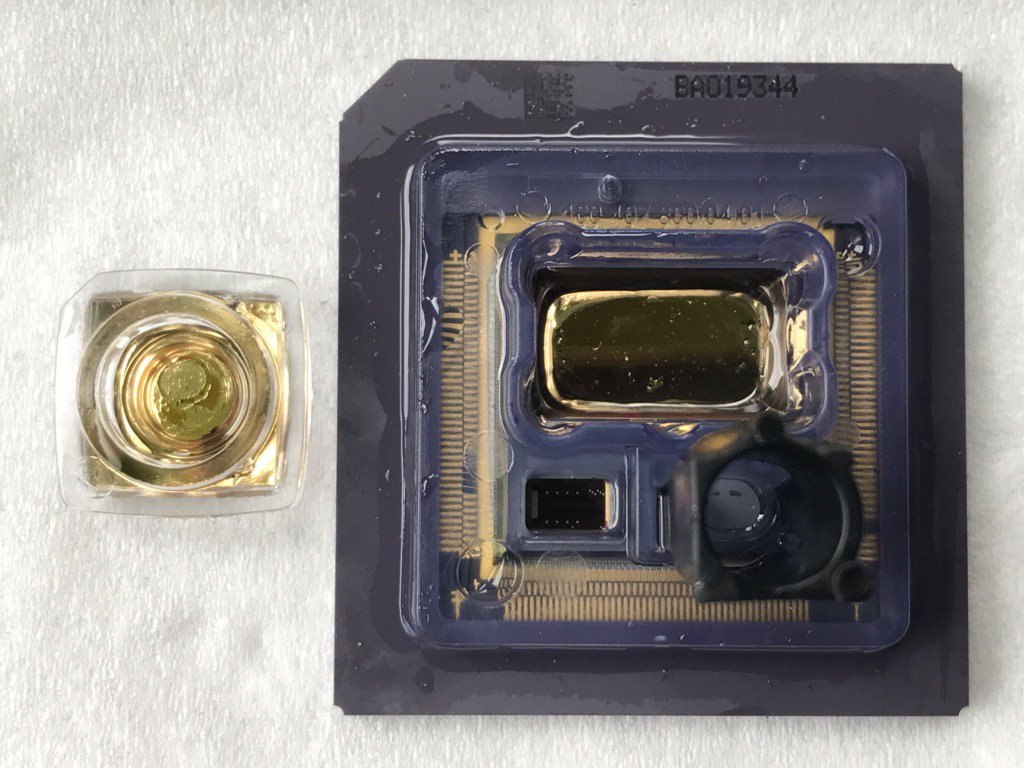

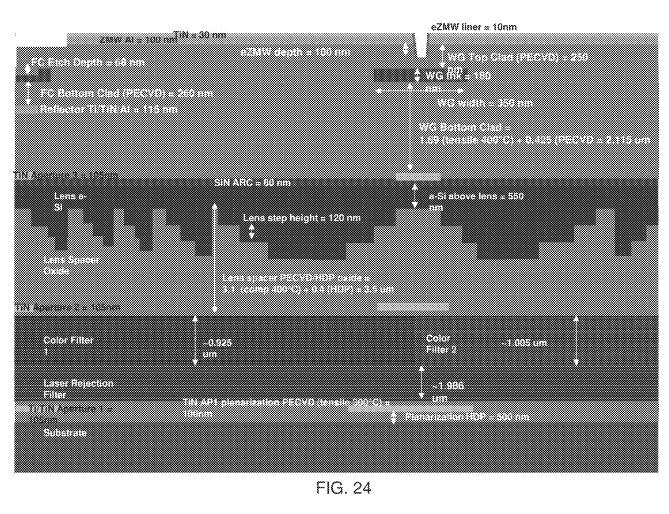

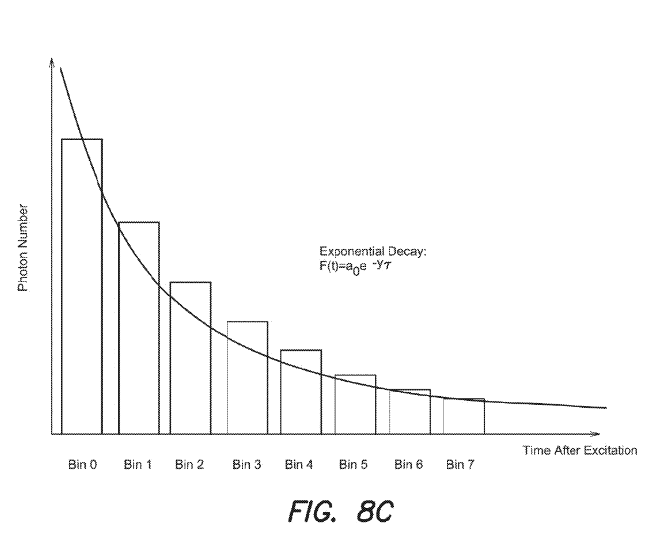

My idea was for a cheap simple device to read/write DNA. I’ve blogged about my approach before here and here, you can find the complete YC application below. While I wasn’t accepted, I interview with YC a pleasant and worthwhile experience. My hope is that this post will encourage other science based startups and solo founders to apply to YC.

My application was for an idea stage startup. I didn’t spend much time putting the application together, went for a walk to think thing over and then did a couple of takes to create the intro video:

As a solo founder, idea stage, science based startup I thought my chances were quite slim. I fired off the application anyway, as the investment of time on my part was relatively low.

You don’t need a deck, and the focus seems to be on the idea and the team. This is in contrast to most seed stage VCs (even accelerators) who require a deck and likely multiple meetings.

The other difference with YC is the timeline is very clear. Many VCs will keep you hanging, not reply, or ask you to check back in after some vaguely specified goal has been reached. It’s understandable, but can be painful.

YC reply on a fixed timeline [1]. This makes the whole process clearer to everybody involved. After putting in my application, I received an email a few days later requesting a phone screen.

The phone screen was about 10 minutes. Quite high level, and mostly just clarified the play, and how it fits into the DNA sequencing space (see the application below if your interested in further details [1]).

The deadline came and went, and I heard back the day after the official deadline that they’d like me to come to Mountain View to interview.

YC cover your travel expenses up to a limit. Coming from Japan, the travel budget was 1000USD and hotel budget 350USD.

The interview process itself was pretty painless. My interview panel consisted of 3 people. One had a background in Biotech and had in fact worked at a DNA sequencing startup.

The conversation was good, they were very focused. They didn’t focus too hard on the technical aspects of the play. After discussing the play and initial focus, we moved on to talk about how I would beat the current market leader (Illumina).

This wasn’t really the play, Illumina are very cheap on cost per base. But their cost per run is very high (500USD+). The idea was to focus on applications were a very low cost per run (10USD) would be beneficial, bootstraping on DIYBio and Synthetic Biology applications. My thesis is diagnostic instrumentation will likely require a cheap run cost… but throughput isn’t so critical for many applications.

But they wanted to see the Illumina-killer play worked though. This is not unreasonable. While this might not be the pitch, I think it’s reasonable that I should have the idea worked through… I guess that I have the “idea maze” fully explored.

In total the interview lasted about 15 minutes.

I heard back later that evening that I didn’t make it into this batch. They gave detailed feedback (which you’ll find at the end of this post [2]), again this is something you don’t receive with most VCs.

I was left feeling quite positive about YC. The process was very clear, and I think they can do a reasonable job of selecting and funding science heavy startups.

They’re quite unique in a number of aspects. The goal seems to be to create an efficient pipeline for selecting startups that can increase their valuation from a nominal 2MUSD to probably ~20MUSD in a 3 month timeline (and eventually growing to unicorn size).

After the 3 month period is up, you get put in front of a bunch of 2nd stage investors and the hope would be that you raise at this increased valuation.

500 startups are interviewed. From my experience I’d guess they spend <30 minutes evaluating each one. This isn’t enough time to do a deep dive, but it’s probably the point of diminishing returns. After this they have a strong enough signal, to filter 500 startups down to 100 which have a reasonable chance of moving forward.

This pipeline likely works as well for science based startups as traditional tech. And I know that in my batch a DNA sequencing startup was selected, and will be following it with interest.

As for me… I’ll probably put my startup on hold for now. The timing isn’t right for me to move to the US, and working on this idea would likely take more money than I have.

If you’re doing a science based startup in Japan, or I could conceivably help out remotely, please get in touch! (new at sgenomics dot org).

Notes

[1] The interview acceptance came about a day late. Given the volume of applications they have I find this more than acceptable.

[2]

I confirmed with YC that they are happy for me to share the feedback, so here it is!

Unfortunately, we’ve decided not to fund Opusone for the winter batch.

This was a close call for us. I was very impressed by your background in the space – we like to fund people who are deep technical experts and you certainly are. We also really like the general pitch of an “altair basic of genome sequencing”. If you’re not familiar with the term, there is a great essay Paul Graham wrote that I think fits very well with your core thesis.

We had two issues that gave us pause. One, it was just very early in terms of either building the device or seeing if a device this low-end would actually be interesting to DIY bio people. And two, it wasn’t clear to us how the device would go from low-end to taking over the mid-tail and eventually taking over the market.

Let me say a little more about the second issue. We’ve seen in past companies that it’s not inevitable that the low-end option ends up taking over the market. Sometimes it gets stuck as an educational tool, which tends to be a small market, as the high-end options continually drive costs down. If you’re pursuing a “altair basic becomes microsoft” strategy, you want to make sure that you have a clear technical path where you can start with a low-accuracy device but keep improving the accuracy until you have something that is competitive with Illumina but less expensive. YC companies like Airbnb and Stripe have done this basic strategy really effectively.

I think you’re onto something here and I’d strongly encourage you to keep working on it and re-apply to YC in March for the June-August batch when you have developed the idea more. If I can be helpful in the meantime, please let me know.

Thanks very much for flying out here from Japan to meet with us. I enjoyed meeting you and hope you’ll keep in touch.

[3]

Application:

COMPANY

Company name:

Opusone

Company url, if any:

[BLANK]

If you have a demo, what’s the url? For non-software, demo can be a video.

(Please don’t password protect it; just use an obscure url.)

[BLANK]

Describe your company in 50 characters or less.

Read/Write DNA Device

What is your company going to make?

A cheap device to read and write DNA aimed at synthetic biology and DIYBio.

Which category best applies to your company?

Biotech

Is this application in response to a YC RFS?

No

Where do you live now, and where would the company be based after YC?

(List as City A, Country A / City B, Country B.)

Tokyo, Japan

CONTACT

Email address of the founder who is filling out this application:

XXXXXXXXXXXXXXX

Phone number(s):

XXXXXXXXXXX

FOUNDERS

Founders

HACKER NEWS USERNAME NAME EMAIL PROFILE UPDATED

new299 Nava Whiteford XXXXXXXXX yes

Please enter the url of a 1 minute unlisted (not private) YouTube or Youku video introducing the founders. (Follow the Video Guidelines.)

Please tell us about an interesting project, preferably outside of class or work, that two or more of you created together. Include urls if possible.

[BLANK]

How long have the founders known one another and how did you meet? Have any of the founders not met in person?

[BLANK]

PROGRESS

How far along are you?

Idea stage, in process of building proof of concept.

How long have each of you been working on this? Have you been part-time or full-time? Please explain.

1 month.

I started developing the concept about a month ago. I’ve ordered reagents, designed PCBs and sent them out for fabrication.

Which of the following best describes your progress?

Unlaunched

When will you have a prototype or beta?

within 6 months

Do you have revenue?

No

How much money do you spend per month?

1000

How much money does your company have in the bank now?

0

How long is your runway?

(e.g. 5 months)

6 months

If you’ve applied previously with the same idea, how much progress have you made since the last time you applied? Anything change?

[BLANK]

If you have already participated or committed to participate in an incubator, “accelerator” or “pre-accelerator” program, please tell us about it.

[BLANK]

IDEA

Why did you pick this idea to work on? Do you have domain expertise in this area? How do you know people need what you’re making?

I’ve worked at many different (5) DNA sequencing companies at various levels, up to CTO.

I feel like I have a good feel for the pain points in development and have developed a unique angle on sequencing.

I think this is an instrument that every synthetic biology or DIYBio lab needs.

What’s new about what you’re making? What substitutes do people resort to because it doesn’t exist yet (or they don’t know about it)?

Slow turn DNA synthesis or sequencing by an external lab.

Who are your competitors, and who might become competitors? Who do you fear most?

There are large sequencing companies (Illumina) and synthesis companies (Twist).

No-one is targeting something very cheap. Nobody is developing a single device to read and write DNA to my knowledge. An existing synthesis company could potentially pivot into this.

Someone suddenly decide to slash their sequencing costs by 1000 fold. A complete product could come out of the blue which does everything I’m considering, at the same cost, and with loads of money backing it.

What do you understand about your business that other companies in it just don’t get?

They want to grow the existing market. I want to build new ones.

How do or will you make money? How much could you make?

(We realize you can’t know precisely, but give your best estimate.)

I think the global market for DNA synthesis alone could grow to ~20BUSD.

How will you get users? If your idea is the type that faces a chicken-and-egg problem in the sense that it won’t be attractive to users till it has a lot of users (e.g. a marketplace, a dating site, an ad network), how will you overcome that?

I’d like to engage with the DIYBio community, and more traditional hacker spaces, and show what can be done with a read/write DNA instrument.

I would engage in early access projects with synthetic biology labs.

EQUITY

Have you incorporated, or formed any legal entity (like an LLC) yet?

No

If you have not formed the company yet, describe the planned equity ownership breakdown among the founders, employees and any other proposed stockholders.

(This question is as much for you as us.)

Solo founder. I have enough experience to build a proof of concept, but I will need to hire technical leadership. I will need guidance on this. I believe a decent CSO will require cofounder level equity for example (10%+).

Please provide any other relevant information about the structure or formation of the company.

[BLANK]

LEGAL

Are any of the founders covered by noncompetes or intellectual property agreements that overlap with your project? If so, please explain.

[BLANK]

Who writes code, or does other technical work on your product? Was any of it done by a non-founder? Please explain.

I’ve worked on everything so far.

Is there anything else we should know about your company?

(Pending lawsuits, cofounders who have left, etc.)

[BLANK]

OTHERS

If you had any other ideas you considered applying with, please list them. One may be something we’ve been waiting for. Often when we fund people it’s to do something they list here and not in the main application.

* Easy mail order water quality testing.

* Using nanopore for DNA synthesis.

* Offline collaboration tools for use in space.

Please tell us something surprising or amusing that one of you has discovered.

(The answer need not be related to your project.)

[BLANK]

CURIOUS

What convinced you to apply to Y Combinator?

I read hackernews, you seem to treat people fairly and I think would be good people to help me get things off the ground.

How did you hear about Y Combinator?

news.ycombinator.com